Signing the deal is often seen as the finish line — but in reality, it’s only the beginning. Despite months of negotiation, due diligence, and optimism on both sides, a significant number of M&A transactions fail to achieve their intended value after signing. Integration missteps, cultural mismatches, unrealistic expectations, and structural weaknesses can quickly erode the promise of synergy.

Understanding why deals underperform post-signing — and how to quantify, mitigate, and manage those risks — is crucial to ensuring lasting success.

Current Situation of Post-Signing Failures

Numerous studies and analyses show that a large share of M&A transactions fails to deliver the expected value after signing. The rate of underperformance or outright failure is around 70–75%.

“Failing” after signing can mean different things: the transaction is rescinded or litigated, the buyer writes the deal down, synergies are missed, or expected returns don’t materialise because integration breaks down.

Common Causes of Failure

In transactions within highly standardized and transparent environments (e.g., large US/EU corporates), fundamental accounting/legal risks are relatively low. Instead, failures often stem from people, culture, integration challenges, long-term strategy shifts, or macroeconomic changes.

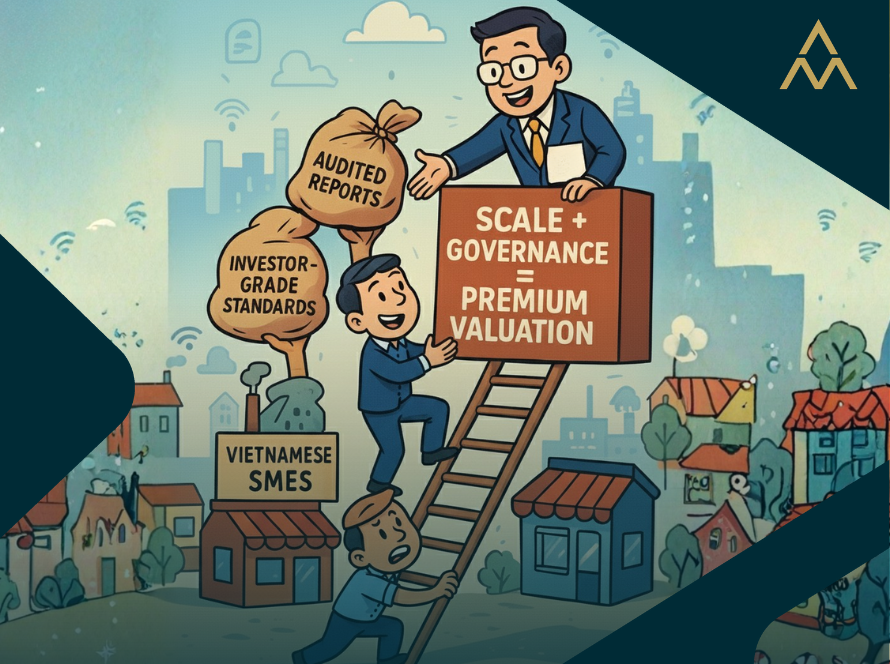

In Vietnam, Southeast Asia, and other emerging markets, basic risks (information leakage, governance structure, legal compliance, payment execution) appear far more frequently than in developed markets.

Among Vietnamese SMEs, post-signing risks often arise from people, brand, and licensing, rather than financial or structural issues.

A common scenario: Founders inflate valuations and set unrealistic KPIs, while buyers structure deals with small upfront payments and larger deferred/earn-out tranches. As a result, founders are contractually locked in under high pressure, creating a lose-lose dynamic.

Profit deterioration post-deal is often foreseeable, but underestimated by founders: customer churn changes sales volume, key staff departures slow down hiring and rebuilding, and work progress suffers delays. In education, curriculum differences can lead to parent rejection, lowering retention rates. In franchise models, founders may be forced to commit to overexpansion beyond their human resource capacity, creating severe strain.

Approach to quantify and manage post-signing risk

Risk Quantification

- Risk register: assign probability and impact to each identified risk to estimate expected losses.

- Risk heatmap: probability–impact matrix to prioritize issues.

- Synergy realization check: detailed modeling at revenue/cost line level, stress-tested across scenarios (30%, 60%, 100% realization).

- Scenario & tail analysis: build base, downside, and worst-case cases; run NPV distribution to assess potential value-at-risk (VaR).

Contractual & Financial Risk-Sharing Tools

- Reps & Warranties Insurance (RWI): transfer misrepresentation risk to insurers, reducing escrow needs.

- Escrow / Holdback + Completion Accounts: retain part of purchase price for post-closing adjustments.

- Earn-out: link purchase price to future performance, sharing risk with the seller.

- Specific indemnities: cover tax, legal, or contingent liabilities.

- MAC clause (Material Adverse Change): exit option if a major adverse event occurs pre-closing.

Execution & Integration Management

- Pre-merger integration planning (3 months): assign synergy owners, design retention packages, IT transition plan, and customer care measures.

- Rapid forensic/audit team: to handle red flags immediately post-closing.

- KPI monitoring & reporting: track 3–6 core KPIs around cash flow, customer retention, and synergy delivery.

- Culture & people: conduct cultural due diligence (surveys, workshops) pre-signing; post-signing, roll out retention and internal communication programs.

- Founders, brand, scalability: assess dependency on founders, brand resilience, scalability of operations, and licensing compliance.

How Alliance Mount Partners with Clients

Managing post-signing risk is critical to M&A success, especially given high failure rates and diverse risk sources spanning people, culture, legal, and financial issues. In Vietnam and other emerging markets, early handling of basic risks alongside long-term integration strategy is essential to optimize synergy value and minimize losses.

Alliance Mount supports clients through tailored, flexible advisory across the entire M&A lifecycle:

- Fit-for-purpose due diligence: structuring and standardization for international deals, deep-dive financials for large transactions, human/brand/legal checks for SMEs.

- Smart deal structuring: earn-outs to retain founders, escrows to safeguard payments, and shareholder agreements to mitigate governance conflicts.

- Culture bridging & integration: joint integration planning, HR communication, and synergy expectation management.

- “Gatekeeper” role: cautioning buyers/sellers against overvaluation and unrealistic growth assumptions.

With international expertise and a client-first orientation, Alliance Mount partners with investors to identify risks early and design pragmatic solutions — from deal structuring to post-merger execution.