As we step into the Lunar New Year, a time traditionally associated with renewal and reflection, investors are faced with a stark contrast between seasonal optimism and market volatility. While Asian markets began the year on a positive note, the global investment landscape was shaken on January 27, when Deepseek, a Chinese AI startup, triggered a historic sell-off in U.S. tech stocks.

Once touted as China’s answer to OpenAI, Deepseek’s advancements and aggressive cost structure have challenged the dominance of U.S. tech giants, leading investors to reassess AI valuations. As a result, the U.S. tech sector lost over $2 trillion in market cap in a single trading session, marking one of the largest AI-driven sell-offs in history.

With AI uncertainty, rising geopolitical risks, and shifting market conditions, should investors avoid U.S. tech in the short term or seize the opportunity to buy the dip? One thing is clear: investors should take a pragmatic and strategic approach to balance risk and reward.

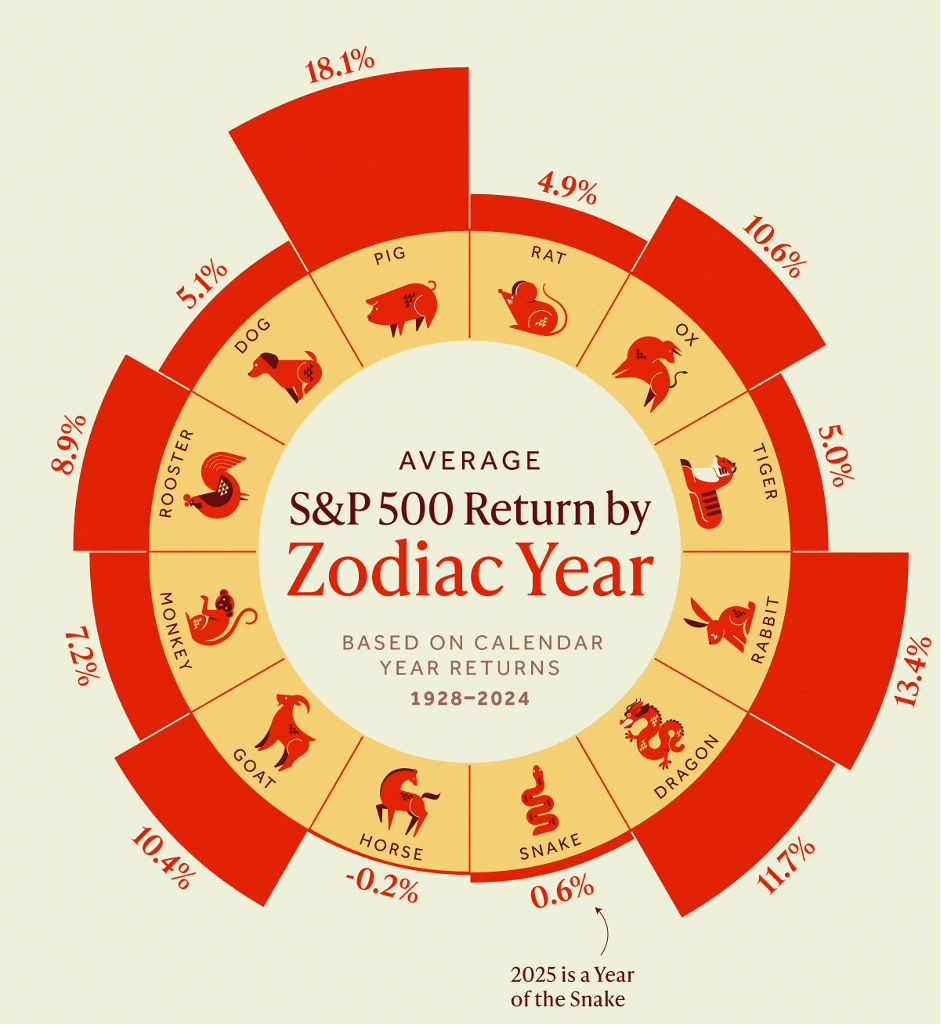

1. Historical Market Performance: Insights from the Asian Zodiac

Throughout history, the S&P 500 has shown varied performance based on different Asian zodiac years.

The Year of the Snake, which we enter in 2025, has historically delivered one of the weakest returns, averaging just +0.6%, second only to the Year of the Horse. While intriguing, these historical trends should be viewed as anecdotal rather than predictive.

Source: Visual Capitalist

Despite the recent turbulence, AI remains a high-growth theme. Investors should take a balanced perspective:

- AI is here to stay, but execution risks are rising.

- Short-term volatility will persist as investors distinguish hype from reality.

- Long-term AI investment remains attractive, with selective opportunities emerging.

- SaaS & vertical AI solutions in emerging markets, such as Vietnam, could provide scalable, stable growth.

2. Key Investment Strategies for 2025

i. Balance Exposure Across Defensive & Cyclical Sectors

- Diversify between energy, manufacturing, and AI/tech growth plays to manage volatility.

- Consider defensive industries like healthcare, utilities, and consumer staples, which tend to perform well during uncertain periods.

ii. Monitor Geopolitical Risks & Trade Policies

- US.-China tensions could impact supply chains, tariffs, and global investment flows.

- Expect increased government intervention in AI and semiconductor industries.

iii. Look for U.S. Domestic Growth Themes

- Reshoring & Infrastructure Expansion – The U.S. is ramping up domestic manufacturing and supply chain resilience, benefiting industrial and materials stocks.

- Deregulation & Tax Policy Changes – A friendlier business environment could boost financials, private equity, and fintech.

Final Thoughts: The Year of the Snake’s Investment Mindset

The Year of the Snake calls for caution, adaptability, and strategic thinking. With heightened volatility in AI, shifting geopolitical dynamics, and evolving market conditions, investors must strike a balance between risk management and seizing opportunities.

Rather than reacting to short-term market swings, those who stay disciplined, diversify wisely, and position themselves for long-term growth will be best equipped to navigate uncertainty. Whether focusing on defensive sectors, emerging market opportunities, or selective plays in AI and technology, success in 2025 will reward those who take a measured approach and adapt to changing conditions.