Trump 1.0: Impact on Cross-Border Investments and M&A (2017-2020)

During Donald Trump’s first term, U.S. trade and investment policies shifted toward protectionism. The “America First” approach led to heightened scrutiny of inbound foreign investment, particularly from China, and accelerated a broader decoupling from Chinese supply chains. Key effects included:

- Stricter Inbound M&A Policies: A 2018 law increased U.S. government scrutiny of foreign investments, especially in key industries like technology and infrastructure, making it harder for overseas buyers to acquire American companies.

- Rise of the China+1 Strategy: The U.S.-China trade war (2018) pushed companies to diversify supply chains, boosting M&A activity in Southeast Asia, particularly in Vietnam and India. Mexico also saw increased investment, but its role as an alternative manufacturing hub is now under threat.

- Tax and Capital Repatriation Effects: The 2017 Tax Cuts and Jobs Act encouraged U.S. companies to repatriate overseas profits, reducing outbound M&A while strengthening domestic reinvestment.

2025-2026: A Return to 2017-2019 Trends?

As we step into 2025, the global investment landscape is once again being shaped by political shifts.

The key questions for investors and M&A strategists are: Will the next two years resemble 2017-2018, marked by heightened optimism and tax incentives? Or will they mirror 2018-2019, characterized by escalating trade tensions and geopolitical uncertainty?

- Regulatory Scrutiny on Foreign Investments: even stricter controls on foreign investments in sensitive sectors like technology and infrastructure, further limiting acquisitions by overseas buyers, particularly from China.

- New Tariffs and Supply Chain Shifts: On February 1, 2025, President Trump issued executive orders imposing new tariffs on imports from Mexico, Canada, and China. While the tariffs on Mexico and Canada were suspended for a month after negotiations, the Chinese tariffs went into effect on February 4. This move mirrors past trade tensions and could disrupt supply chains further, accelerating the China+1 shift. Companies relying on Chinese imports may seek alternative suppliers in Southeast Asia or reshore production to the U.S.

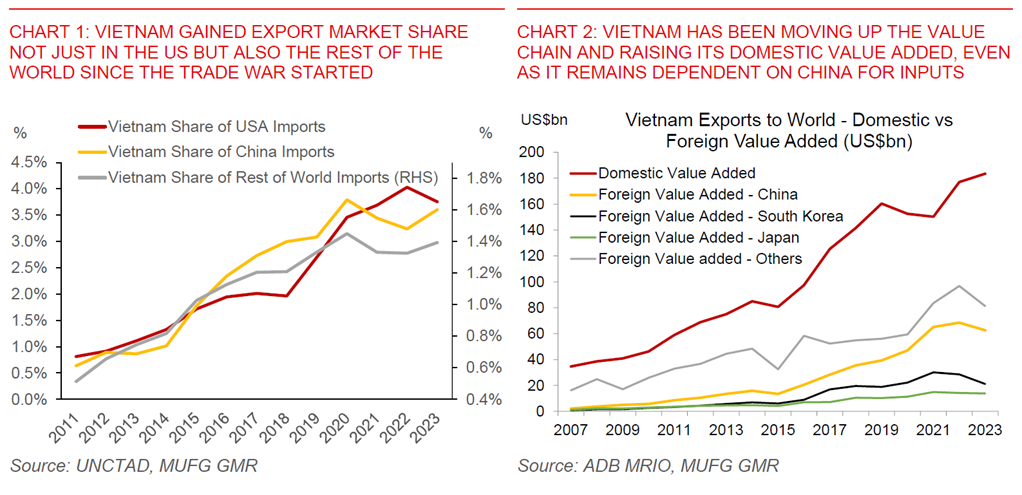

- Reinvigoration of China+1: Regardless of political outcomes, the decoupling momentum will persist. Vietnam’s export market share continues to grow as companies seek alternatives to China. Since the trade war, its role in global supply chains has expanded, supported by rising domestic value-added and a more complex export basket. If sustained, this shift could help shield Vietnam from potential U.S. tariffs. While the country remains an attractive destination for manufacturing and investment, its reliance on Chinese inputs poses supply chain risks. To strengthen its position, Vietnam must boost domestic production, technology, and supplier diversification. With a more technically skilled workforce and industrial growth, it is well-placed to attract global investors and enhance supply chain resilience.

- Tax Policy and Domestic Repatriation Effects: A new Trump administration might introduce tax reforms favoring domestic reinvestment, which could slow outbound U.S. acquisitions while boosting onshore industrial investments. However, global capital pools will still seek diversification, ensuring sustained interest in cross-border transactions.

Outlook for Investors in 2025

Geopolitical risks, supply chain diversification, and regulatory hurdles will remain critical themes. Cross-border investors must stay agile, leveraging regional advantages and assessing policy developments to navigate the shifting global investment terrain effectively.

As businesses return to work in 2025, those with a well-calibrated cross-border strategy will be best positioned to seize emerging opportunities while mitigating risks in an increasingly complex world.