As the U.S. earnings season for Q4 2024 kicks off, analysts and investors are bracing for a crucial period that will set the tone for the markets in 2025.

With projections of 15% earnings growth for 2025, this earnings season will offer valuable insights into corporate resilience and strategic priorities. Drawing parallels to the pre-Trump era of early 2017—another period of significant transition—provides context for how companies may respond to today’s challenges. Additionally, cross-border M&A, particularly into high-growth Asian markets, remains a critical lever for companies seeking long-term expansion in a shifting global economy.

This article explores key expectations for Q4 2024 earnings, compares the current macroeconomic environment to Trump 1.0, and analyzes the potential impact on cross-border M&A activity.

1. What To Expect: Upside Surprises or a Reality Check?

Earnings Expectations

As of this writing, major U.S. banks have just announced their Q4 2024 earnings, which have significantly exceeded expectations, setting a positive tone for the broader earnings season. These results demonstrate that financial institutions are effectively navigating the current challenges posed by high interest rates and moderating inflation.

The strong earnings surprises, fueled by robust investment banking revenues, resilient net interest margins, and solid consumer credit performance, have elevated expectations for other sectors. This reinforces a key narrative for this earnings season: the resilience of corporations amidst persistent macroeconomic challenges.

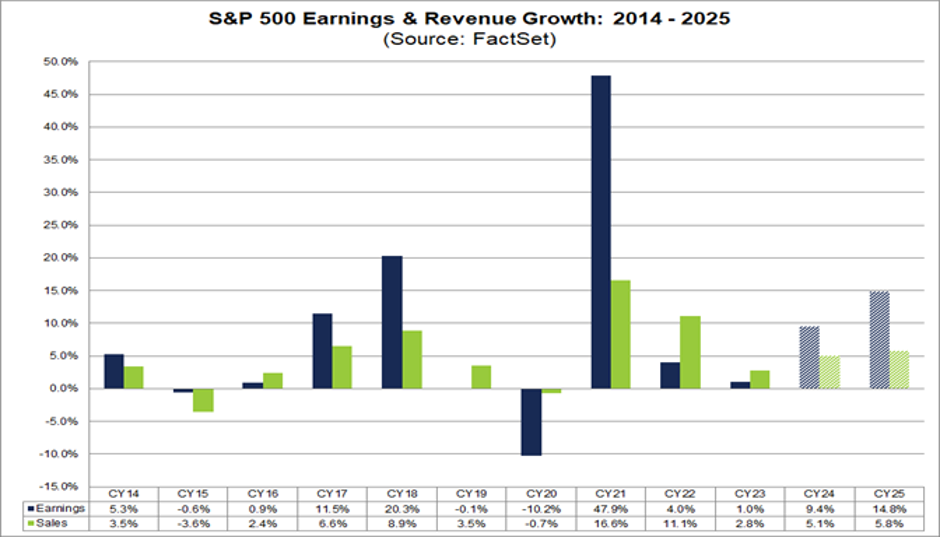

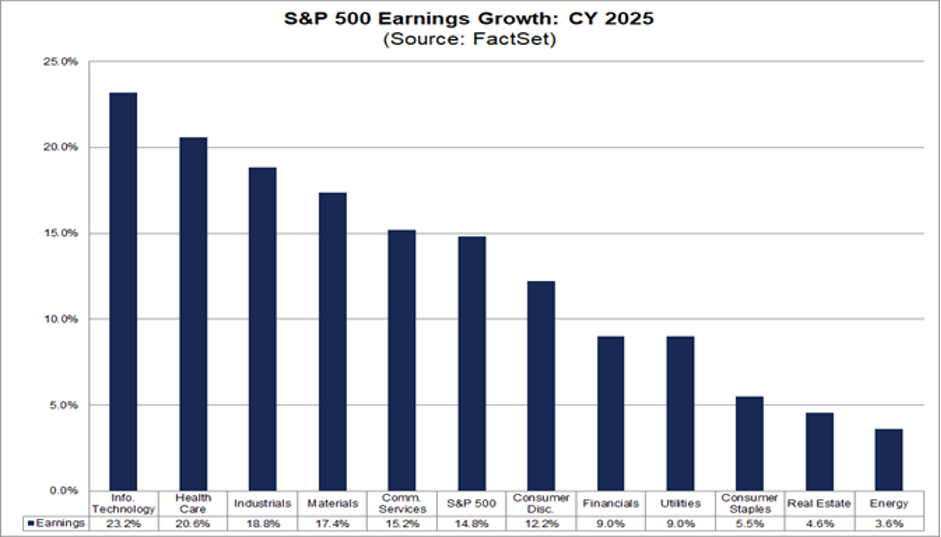

According to Factset, analysts project a 15% earnings growth for the S&P 500 in CY 2025. While this reflects optimism about easing inflation and potential rate cuts by the end of 2025, the Q4 2024 earnings will provide a more immediate reality check on how companies are navigating persistent macroeconomic headwinds.

- Margin Pressures: Although input costs have eased compared to early 2024, persistent wage pressures and high financing costs due to elevated interest rates continue to weigh on corporate margins.

- Sector Performance: Technology and healthcare are expected to remain resilient, benefiting from secular growth trends and strong balance sheets. In contrast, interest-sensitive sectors such as real estate, consumer discretionary, and industrials may report weaker results.

Potential Upside Surprises

Despite the cautious outlook, certain areas could deliver upside surprises:

- Technology: Companies in artificial intelligence (AI), cloud services, and cybersecurity could outperform expectations, driven by robust demand and ongoing digital transformation across industries.

- Financials: Large banks, including JPMorgan and Bank of America, may post better-than-expected results due to strong net interest margins (NIMs) and resilient consumer credit performance. However, guidance on loan growth and credit quality will be critical.

- Energy: While energy prices have softened compared to mid-2024, integrated energy companies may still deliver solid results, supported by disciplined capital expenditure and stable downstream operations.

2. Trump 2.0: Will This Time Be Different?

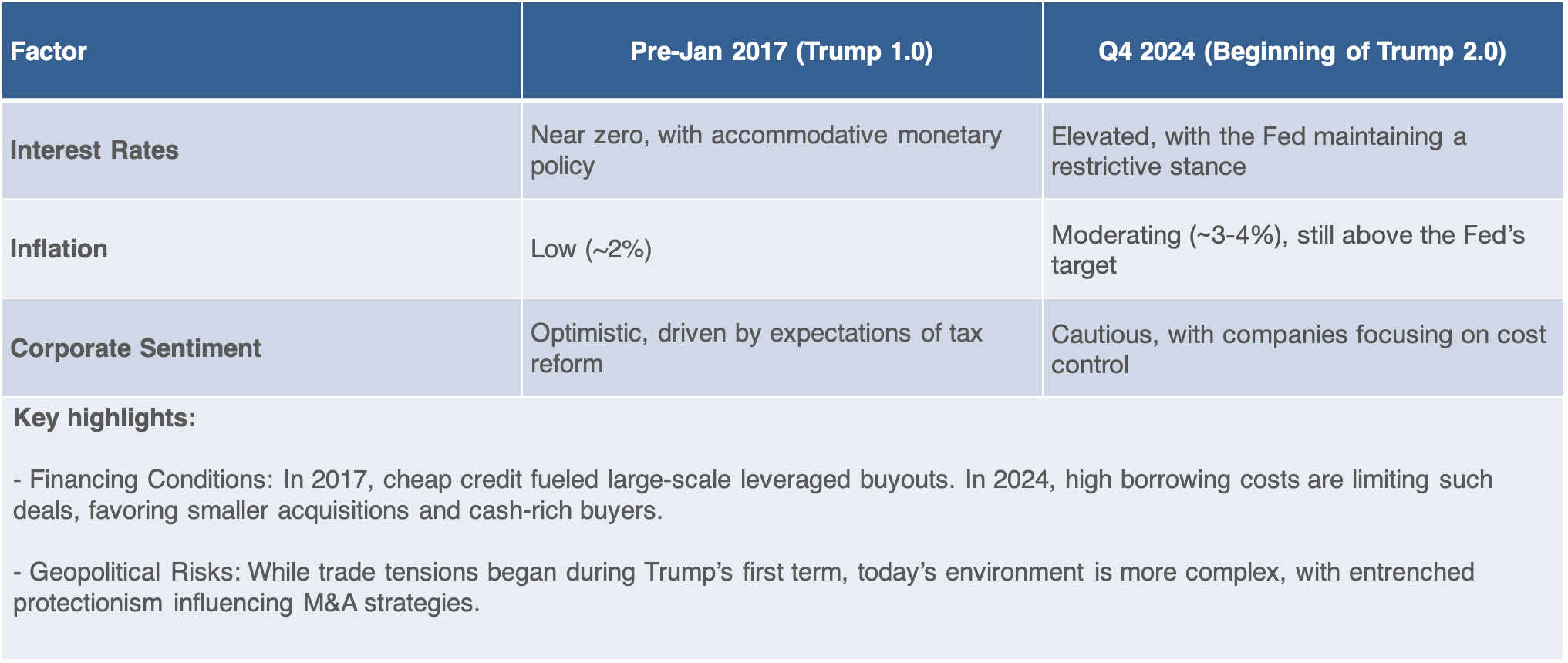

In 2017, corporate sentiment was buoyed by expectations of tax cuts and deregulation, leading to aggressive growth-driven M&A. Companies expanded both domestically and internationally, leveraging low borrowing costs.

Today, while companies remain focused on expansion, they are more selective due to higher financing costs and global demand uncertainties. Strategic priorities have shifted towards supply chain diversification, cost efficiencies, and regional expansion into high-growth markets like Asia.

3. M&A Cross-Border into Asia: Strategic Moves in a Shifting Landscape

U.S. Outbound M&A into Asia

U.S. companies, particularly in technology, healthcare, and infrastructure, are likely to continue pursuing M&A opportunities in Asia, driven by the need to diversify away from slower domestic growth and hedge against geopolitical risks. Additionally, the strong U.S. dollar provides a significant cost advantage, enabling U.S. firms to acquire Asian assets at relatively lower prices.

Key markets include India, Vietnam, and Southeast Asia, where rapid digital transformation, a growing middle class, and infrastructure development present significant opportunities.

Europe Outbound M&A into Asia

European firms are increasingly targeting Asia to mitigate slow domestic growth and diversify supply chains. Key sectors include industrial goods, renewable energy, and consumer goods, with Southeast Asia and India being prime focus areas.

Japan Outbound M&A into Asia

Japan’s outbound M&A into Southeast Asia and India remains robust, driven by its need to counter domestic stagnation and leverage cheap financing. Focus areas include manufacturing, technology, and financial services, with a long-term view on regional integration and growth.

Conclusion

As the Q4 2024 earnings season unfolds, markets will closely watch for signs of resilience or weakness across key sectors. While the macroeconomic context differs significantly from the pre-Trump era in early 2017, one constant remains: companies will continue to seek growth through strategic cross-border M&A. However, unlike the aggressive, growth-driven deals of 2017, today’s M&A landscape is more selective, focusing on value creation, supply chain diversification, and regional expansion in high-growth Asian markets.

U.S., European, and Japanese firms will remain key players in cross-border M&A into Asia, with technology, healthcare, renewables, and infrastructure leading the charge. Despite the challenges posed by high financing costs and geopolitical risks, Asia’s long-term growth potential will continue to attract global investors and acquirers.