GLOBAL EQUITIES: 2024 A Remarkable Year

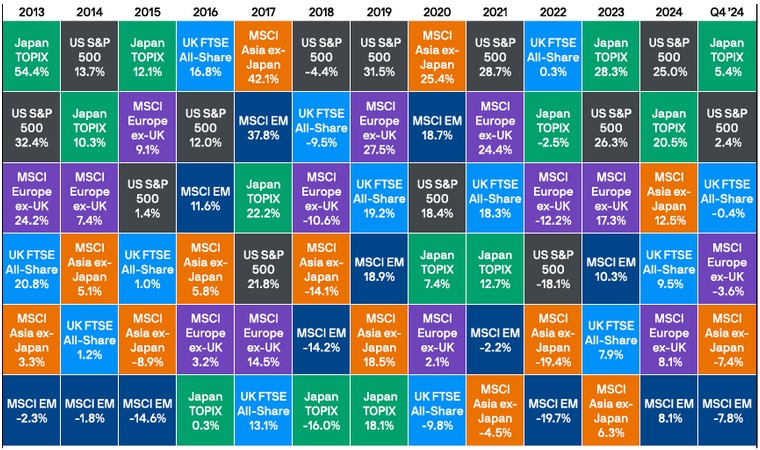

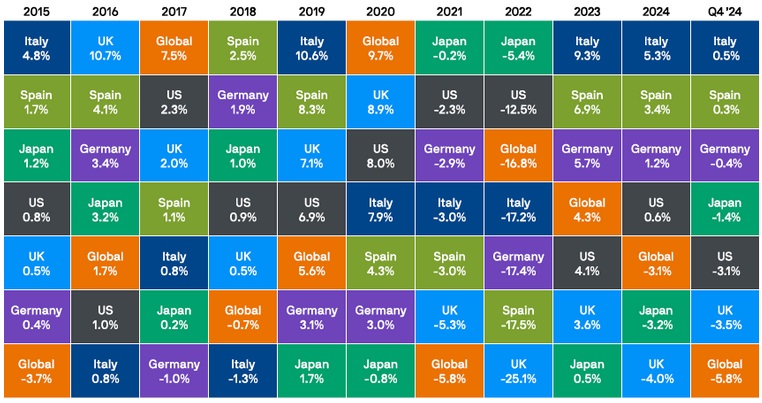

For investors, 2024 proved to be a year of unexpected developments, challenging many initial projections by economists and strategists. The standout performer was the S&P 500 Index, which climbed over 25%, significantly exceeding Wall Street expectations and delivering one of its best annual returns in decades.

Developed Markets Equities : achieved a total return of 19.2%, with the S&P 500 leading at 25.0%. This performance was again largely driven by the “Magnificent Seven” AI-focused technology companies, whose robust earnings contributed to the dominance of growth stocks for the second consecutive year.

Emerging Markets Equities : returned 8.1%, bolstered by a late-year rally in Chinese equities and strong performances from India and Taiwan. China’s market rebound in the latter half of the year resulted in a 19.8% annual return, following cohesive policy measures aimed at economic revitalization.

Source: Bloomberg, BofA/Merrill Lynch, J.P. Morgan Economic Research, LSEG Datastream, J.P. Morgan Asset Management, as of December 31, 2024.

Key Highlights:

- U.S. Economy Resilience: The U.S. economy grew 2.9% despite aggressive rate hikes, with the S&P 500 surging over 25%, led by technology stocks.

- China’s Recovery: The MSCI China Index rebounded 19.4% after two years of declines, fueled by late-year policy support.

- Consumer and Housing Strength: Spending and employment defied expectations, while housing markets remained stable despite high mortgage rates.

Key Drivers:

- Inflation and Policy Shifts: Slowing inflation and central banks signaling policy pivots boosted investor confidence.

- Sector Leadership: Technology and energy sectors drove gains, with AI and cloud computing as major themes.

- Geopolitical Resilience: Strong earnings and consumer demand outweighed geopolitical tensions in Ukraine and the Middle East.

FIXED INCOME: A Muted Year

For bond investors, performance in 2024 was relatively subdued. High-yield sectors delivered strong returns, while investment-grade and government bonds faced headwinds from rising yields and monetary policy adjustments.

Source: Bloomberg, BofA/Merrill Lynch, J.P. Morgan Economic Research, LSEG Datastream, J.P. Morgan Asset Management, as of December 31, 2024.

HEDGE FUNDS: A Year of Solid Performance

In 2024, hedge funds, gold, and broad-based commodities stood out as strong alternative investments, leveraging market volatility and macroeconomic dynamics.

- Hedge funds achieved robust double-digit returns, excelling in equities, currencies, and commodities trading, while quantitative strategies also thrived.

- Gold surged 27.1%, its best annual performance since 2010, driven by U.S. rate cuts, geopolitical tensions, inflation concerns, and record central bank demand.

- Broad-based commodities delivered a 5.4% return, led by price spikes in cocoa and coffee, though constrained by weak demand from China.

Together, these investments demonstrated resilience and diversification potential amid economic uncertainty and monetary shifts.

2025 – Maintaining or Adopting New Strategies?

Even with equity markets at record highs, continuing to invest remains essential, as a well-diversified portfolio is key to managing risks and seizing opportunities.

GLOBAL EQUITIES

Rather than broadly reducing equity allocation, a selective rebalancing strategy is recommended. While elevated valuations may limit upside in some areas, opportunities remain in:

- Value stocks and small-to-mid-cap equities.

- US equities benefiting from regulatory rollbacks, potential corporate tax cuts, and relative insulation from trade tensions.

- Japanese equities, which stand to gain from governance improvements and macroeconomic stability.

- In emerging markets, sectors like AI and green energy offer growth potential but require a risk-conscious approach due to geopolitical uncertainties.

By reallocating toward areas with attractive valuations and strong growth catalysts, investors can capture returns while managing risks in a challenging market environment.

FIXED INCOME

The current environment presents a compelling case for reallocating excess cash into high-quality fixed income as part of a diversified portfolio. With moderating inflation and slowing economic growth signaling a potential peak in yields, fixed income offers attractive risk-adjusted returns and income-generation opportunities.

- 10-year US Treasury yields of 4.3% to 4.5% represent a favorable entry point, particularly with expectations of rate cuts in early 2025.

- Increasing exposure to longer-duration US government bonds is advisable, as the current shape of yield curves and the likelihood of falling interest rates strengthen the case for capital appreciation and portfolio stability.

HEDGE FUNDS & GOLD

Given the current market environment, increasing hedge fund exposure is a strategic move to enhance portfolio resilience, reduce risk, and capture uncorrelated returns. Hedge funds are particularly well-suited for navigating market volatility and synchronized risks across traditional asset classes.

Key Strategies to Focus On:

- Low Net-Long/Short Equity Strategies: These strategies help mitigate market directionality risks while capitalizing on sector dispersion, offering downside protection and selective upside potential.

- Global Macro Funds: These funds exploit macroeconomic trends and divergent global cycles, providing strong diversification and uncorrelated returns during periods of uncertainty.

- Multi-Strategy Platforms: Offering flexibility to shift across various strategies, multi-strategy platforms ensure consistent performance and robust risk management in varying market conditions.

Gold also remains a valuable hedge against inflation and geopolitical risks. While its stellar performance in 2024 may not repeat, it continues to serve as a critical portfolio diversifier.

CONCLUSION

Despite the strong performance of traditional and alternative asset classes in 2024, a dynamic and well-diversified approach remains crucial for 2025. By selectively reallocating equity exposure, increasing allocations to high-quality fixed income, and strategically enhancing hedge fund exposure, investors can position their portfolios to navigate potential volatility while seizing new opportunities.