As 2025 reaches its midpoint, global M&A markets reveal a tale of two directions. Worldwide, dealmakers are showing renewed confidence but a sharper focus—pursuing fewer, larger, and more strategic transactions amid persistent macro frictions. In contrast, Vietnam continues to move on a different trajectory: more deals, smaller checks, and a deepening mid-market dynamic shaped by domestic investors, evolving regulation, and selective inbound interest.

The following highlights how global M&A trends diverge from Vietnam’s unique trajectory — and the areas where Alliance Mount remains most active through the rest of 2025.

Global snapshot

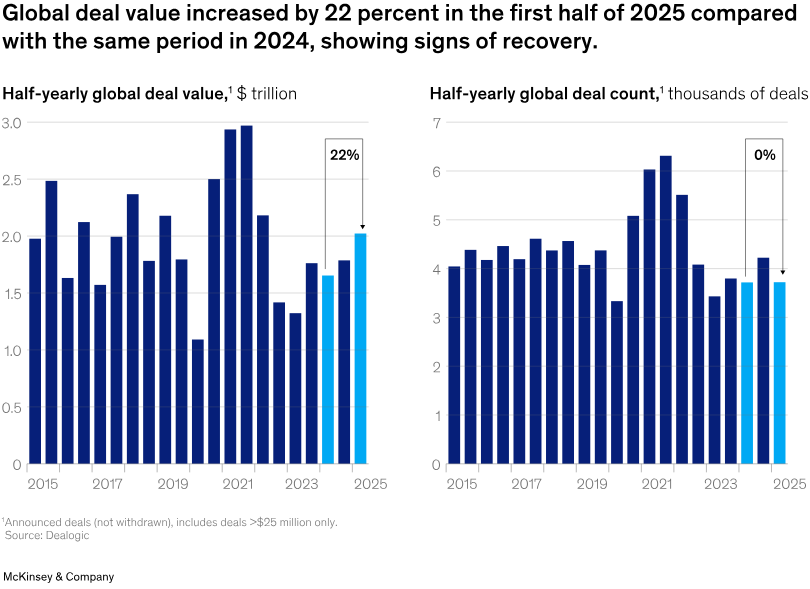

Fewer deals, bigger tickets

In 1H25, global volumes fell ~9% Year-over Year while values rose ~15%, as boards prioritized fewer, more strategic transactions. Macro frictions (sticky rates, tariff noise, and geopolitics continue to filter out marginal deals.

Megadeals lift values and average size up

McKinsey tracks +22% Year-over Year value for $25m+ deals to $2T, with average deal size hitting ~$544m, a five-year high, driven by TMT, energy/power and financials.

Sector leadership

TMT/AI infrastructure reclaimed the top spot by value, with power & utilities/energy transition and financial services also prominent. Expect continued “flight-to-quality” toward resilient, asset-light or tariff-resistant models (e.g., IT/business services).

Vietnam: a different path

Fragmented market, mid-market bias

Vietnam’s landscape remains highly fragmented with limited true megadeals. Average disclosed deal size contracted from ~$52.3m (2023) to ~$41.5m (2024) and to ~$23.5m in Q1-2025 (July 2025: $23.1m). In effect, activity is dominated by small- and mid-sized transactions, often < US$50m.

Active sectors

2025 activity concentrates in Real Estate, Technology, Healthcare, and Energy; inbound remains selective, with domestic buyers more visible than a year ago.

Policy & capital backdrops

Real-estate and investment law updates underpin project transactions; capital-markets reforms (and the FTSE Russell upgrade to “emerging market”) should, at the margin, deepen liquidity and support future pipelines.

Alliance Mount’s lens: 2025 outlook & where we’re most active in Vietnam

Mandate & deal size

We are sector-agnostic but typically avoid Real Estate and Banks. Our focus is < US$100m transactions, with the majority < US$50m.

IT / Digital & data infrastructure

Extensive pipeline across IT services, vertical software, managed/cloud, cybersecurity, and data-center adjacencies (power, interconnect, edge). Common plays: roll-ups, cross-border capability buys, and carve-outs.

Manufacturing (Food & Beverage)

Buy-side M&A demand is rising. Heightened political/policy uncertainty in Thailand has constrained Thai packaged-food and packaging/input supply in select importing markets, prompting incremental export orders to Vietnamese producers (contract manufacturing, private label, co-packing). We focus on < US$50 processes with clear capacity/utilization plans, export readiness, and clean compliance.

Renewable energy

Ongoing consolidation in hydro/solar and portfolio rebalancing. Diligence priorities: policy/approvals mapping, PPA & offtake terms, curtailment risk, payment cycles. Structures often include minority growth, platform bolt-ons, and portfolio reshuffles.

Education (Especially EdTech)

Selective growth in digital learning platforms, B2B training, assessment/testing where content + tech scale together. Deal types: minority growth, JVs/strategic partnerships, and buy-and-build of niche providers.

Overall, Vietnam’s 2025 M&A offers wide opportunity at modest deal sizes, with the most durable momentum in IT/digital, renewable energy, education/EdTech, and manufacturing (F&B), plus selective runs in healthcare and logistics, all squarely within Alliance Mount’s <US$100m (majority <US$50m) sweet spot.